Where you've been tells you where you're going.

In the landscaping industry, where competition is fierce and price sensitivity is high, knowing your financials is more than just a matter of keeping the books in order—it’s about steering your company towards long-term success. Think of your financial statements as a roadmap. By analyzing them carefully, you can gain insight into where your business has been and make informed decisions on where it needs to go.

As the owner or general manager of a landscaping company with 50 to 150 employees, you're juggling a lot of responsibilities, from ensuring quality work to managing client relationships. However, one of the most critical aspects of running your business is understanding your financial health. Whether you're servicing residential or commercial accounts, being in tune with your key financial metrics can make the difference between a profitable season and one that leaves you scrambling to keep the doors open.

The importance of financial insights in a competitive market

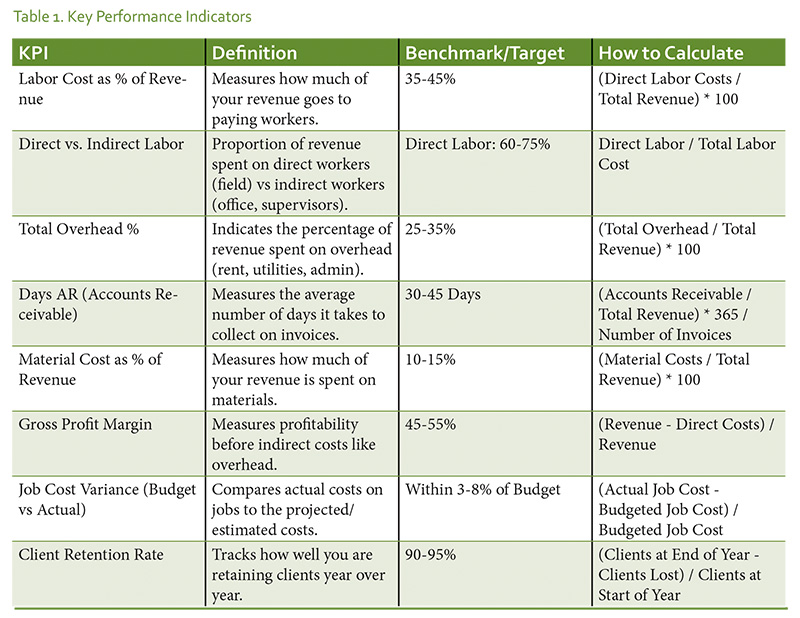

Landscaping companies operate in a market where margins are tight, and competition is relentless. To thrive in this environment, you need to understand the financial indicators that drive your business’s profitability. Key metrics such as labor costs as a percentage of revenue, overhead, days in accounts receivable (AR), and material costs as a percentage of revenue provide invaluable insight into your company’s performance.

But it’s not just about tracking these metrics. You also need to drill down into the details—comparing actual versus budgeted figures for specific jobs, analyzing trends, and recognizing the key drivers of your business’s profitability.

Key benchmarks to watch

Table 1 shows some of the key performance indicators (KPIs) that are critical for every landscaping company owner to understand.

Dashboard examples:

Keeping your eye on the most critical indicators

Once you’ve identified the most important KPIs for your business, the next step is to track them consistently. Using a financial dashboard can help you monitor these metrics daily and make decisions based on real-time data. Here are a few dashboard examples to help you stay on top of your landscaping company’s financial health.

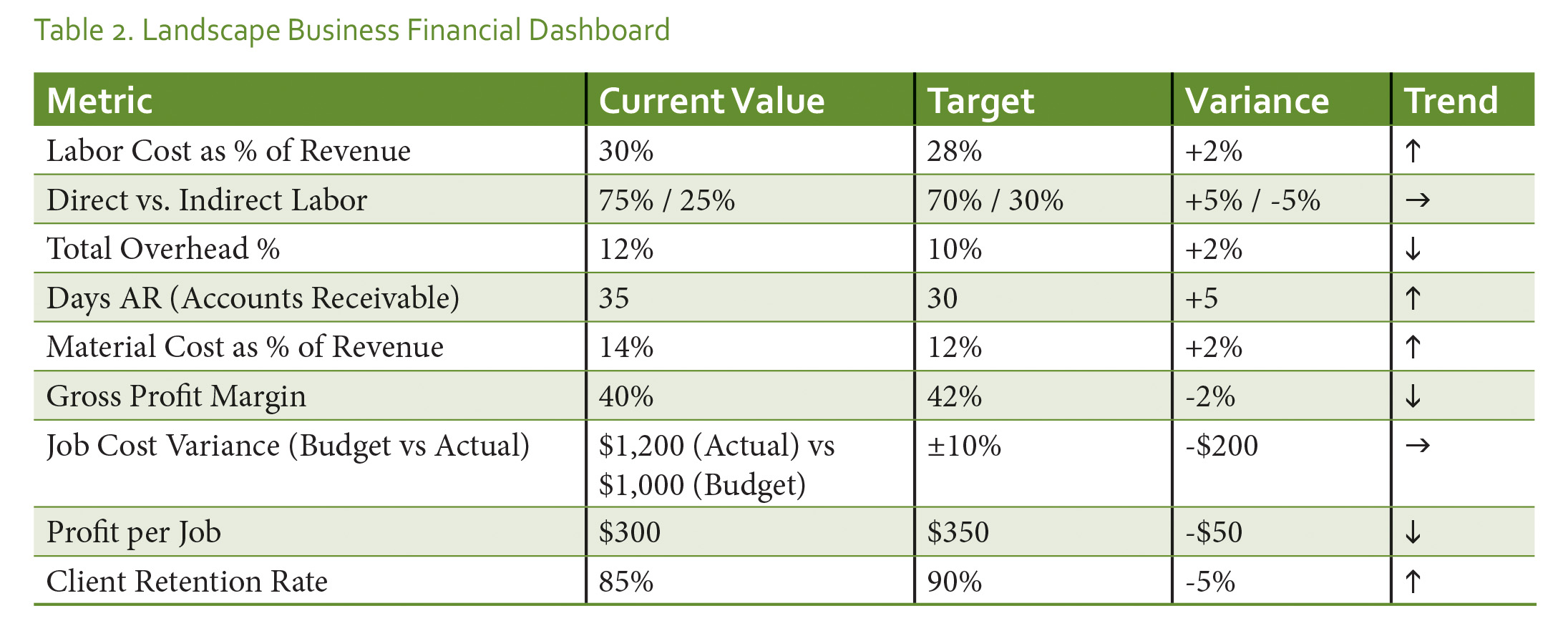

Landscape Business Financial Dashboard

The dashboard in Table 2 focuses on overall financial health and key metrics that can influence daily decision-making. The target values should be set based on your current position vs. your budgeted position and where you intend to end up.

Explanation:

- Labor Cost as % of Revenue: If this percentage creeps higher than your target, it could indicate inefficiencies in fieldwork or overstaffing. This dashboard helps you spot trends in real-time, allowing you to adjust before costs spiral out of control.

- Days AR: If your accounts receivable are climbing, it’s a sign that you may need to speed up your invoicing or collections processes. This metric directly impacts your cash flow.

- Job Cost Variance: Tracking actual versus budgeted costs on each job helps you identify whether your estimates are accurate or if there are inefficiencies causing cost overruns.

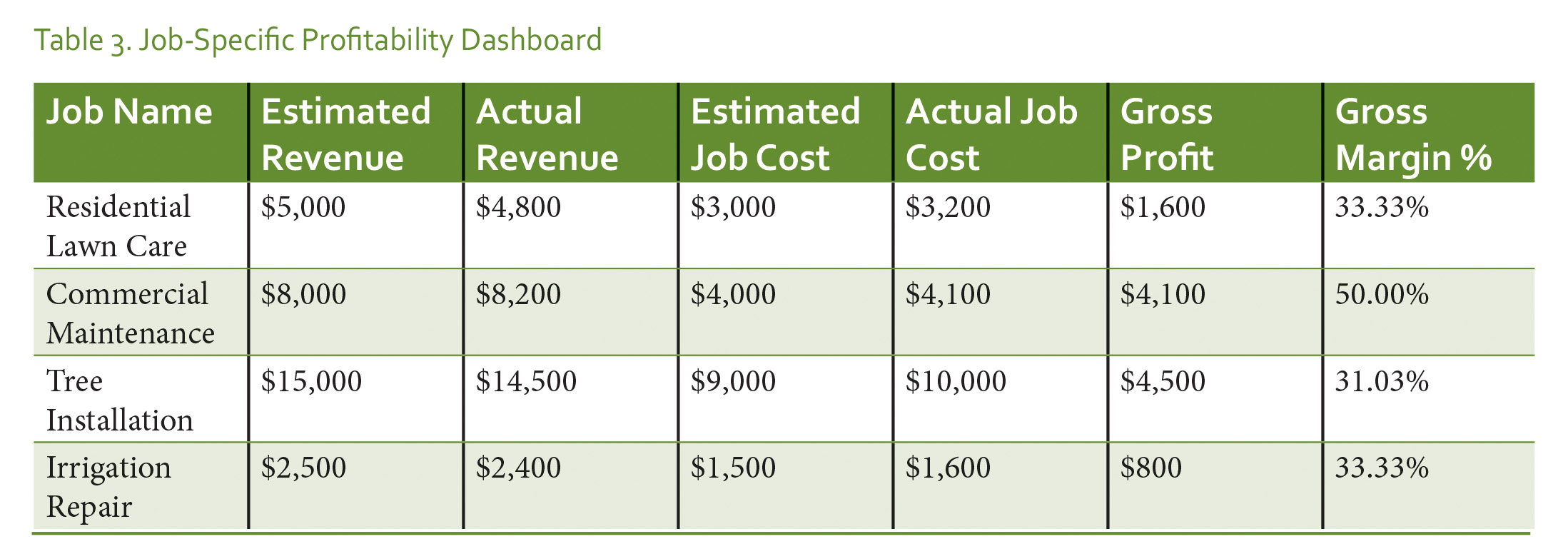

Job-Specific Profitability Dashboard

For a more detailed view, the dashboard in Table 3 tracks the profitability of individual jobs, comparing estimated revenue and costs with actual outcomes.

Explanation:

- This dashboard helps you track the profitability of each job type in real-time. If your gross margin percentage is falling below target, you can investigate whether you need to adjust pricing or improve efficiency in specific areas like labor or materials.

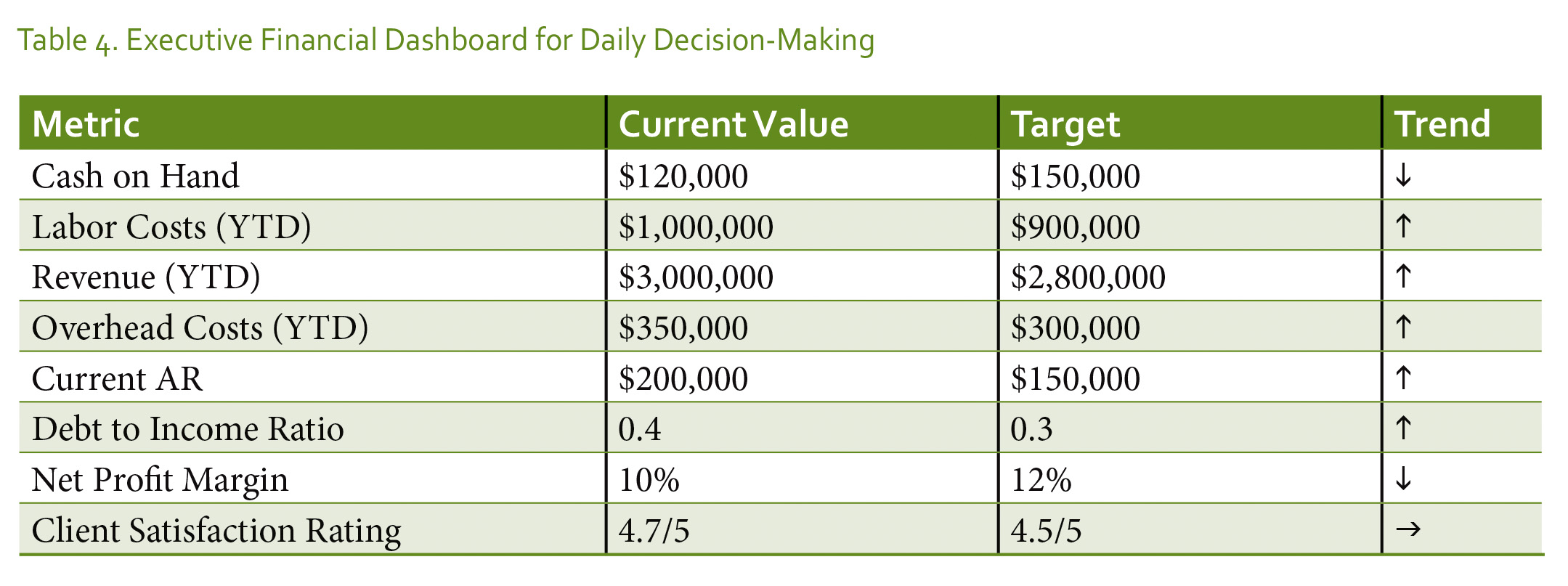

Executive Financial Dashboard for Daily Decision-Making

Table 4 shows a simplified view for the business owner or GM to quickly assess the most important financial metrics and make decisions for the day.

Explanation:

- This dashboard gives the business owner a quick overview of the cash flow, labor costs, and accounts receivable. A rising debt-to-income ratio or overhead costs could indicate the need for cost control measures or additional financing.

- The net profit margin helps track whether your revenue growth is translating into profits, while the client satisfaction rating gives insight into the health of client relationships.

The key to success: Financial education and engagement

As a business owner or general manager, it’s not enough to rely on your CFO, controller, or bookkeeper to manage the numbers. You need to become well-versed in financial statement analysis and financial management. This will allow you to recognize trends, adjust budgets, and ensure profitability without bottlenecks in the information flow.

Without a solid understanding of your financial statements, you could miss critical errors or potential fraud, jeopardizing the success of your landscaping business.

By leveraging financial dashboards and becoming more engaged with your financial data, you can ensure that your business stays competitive, profitable, and ready for growth.

Conclusion

The landscaping industry may be highly competitive, but understanding your financials can give you the edge you need to succeed. By monitoring key performance indicators, using dashboards for real-time decision-making, and becoming financially literate, you can steer your company towards long-term profitability and growth. After all, the financial roadmaps are there for a reason—use them to guide your business towards success.