The Georgia Urban Ag Council conducted their 30th survey of Georgia sod producers. The purpose of the survey was to determine the status of inventory levels and projected price changes for spring and early summer 2025.

Bullet points from the 2025 Sod Producers Report

- 2025 could be a year with less price variability throughout the year.

- Supply of bermudagrass and zoysiagrass are strong entering the 2025 growing season.

- Freight rates are likely to be higher than previous years.

- The average price for certified grass decreased to 2.0 cents per square foot.

- 2025 is a year new production fields are being cleared, planted, and grown, expecting continued growth throughout Georgia and the Southeast.

Survey details

This year, 23 producers participated in the survey, representing farm sizes which were:

- less than 300 acres (9 participants)

- 300 to 600 acres (6 participants)

- 601 to 900 acres (3 participants)

- more than 900 acres (5 participants)

The survey obtained estimates of the inventory for bermudagrass, zoysiagrass, centipedegrass, St. Augustinegrass, and tall fescue based on estimated sales for 2025 as excellent (more than 10% of demand), adequate (equal to demand), and poor (more than 10% shortage).

Pricing information included farm price and price for truckload orders to the Atlanta area or within 100 miles of the farm, all costs were reported as price per square foot of sod.

Inventory levels

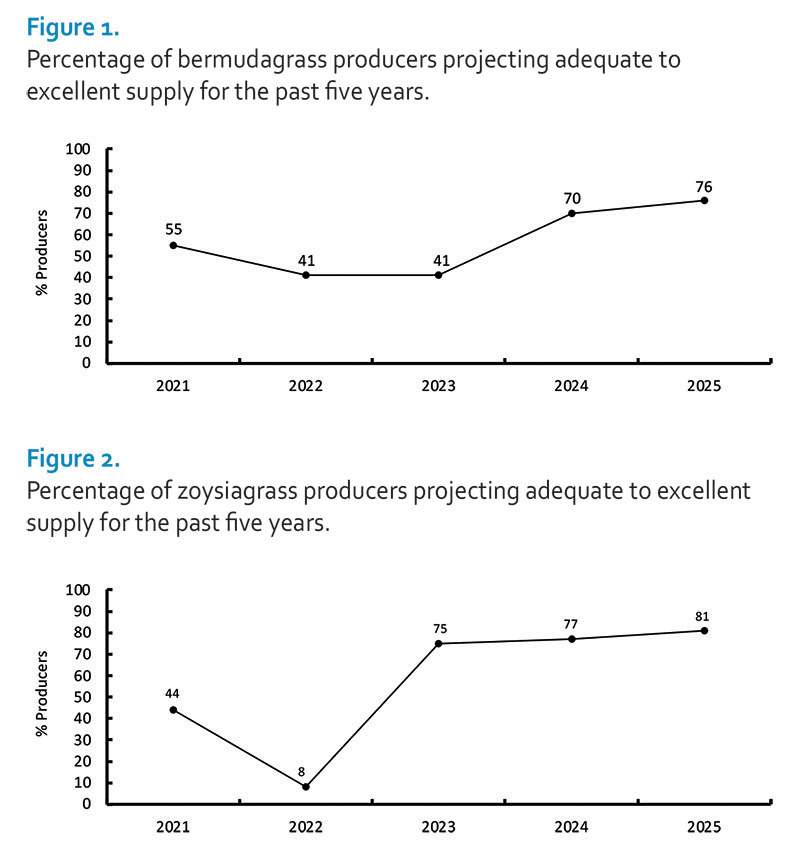

Bermudagrass is being grown by 21 of the surveyed producers. Seventy-six percent of the producers rated their inventory as adequate to excellent this year (Figure 1). Better than one-third of the growers with greater than 600 acres anticipate an insufficient bermudagrass supply, while two producers with 600 acres or less project having poor inventory. For 2025, it would be expected that bermudagrass supply will likely meet market demand.

The number of producers growing zoysiagrass (69%) was similar to previous surveys. Zoysiagrass is a popular species with many commercially available cultivars. There are at least fourteen zoysiagrass cultivars being grown in Georgia. Continuing a three-year trend, zoysiagrass is forecast to be in excellent supply (Figure 2). Sixty-three percent of all growers forecast an adequate zoysiagrass supply in 2025. Additionally, two growers with greater than 900 acres in total production having excellent supply to begin the growing season.

Of the 23 producers surveyed, 14 (61%) were growers of centipedegrass. Seventy-one percent of the growers had adequate to excellent inventory compared to 72% in 2024, and 57% in 2023. Of the larger growers, all expect an adequate to excellent centipedegrass supply.

St. Augustinegrass is being grown by 11 of the 23 producers surveyed. Forty-five percent reported a poor supply. Because of environmental conditions, St. Augustinegrass is difficult to produce in Georgia where our producers have difficulty efficiently “lifting” sod until mid-June.

Similar to previous years, tall fescue was grown by 35% of producers. All of Georgia’s tall fescue producers reported adequate to excellent inventory.

Sod prices

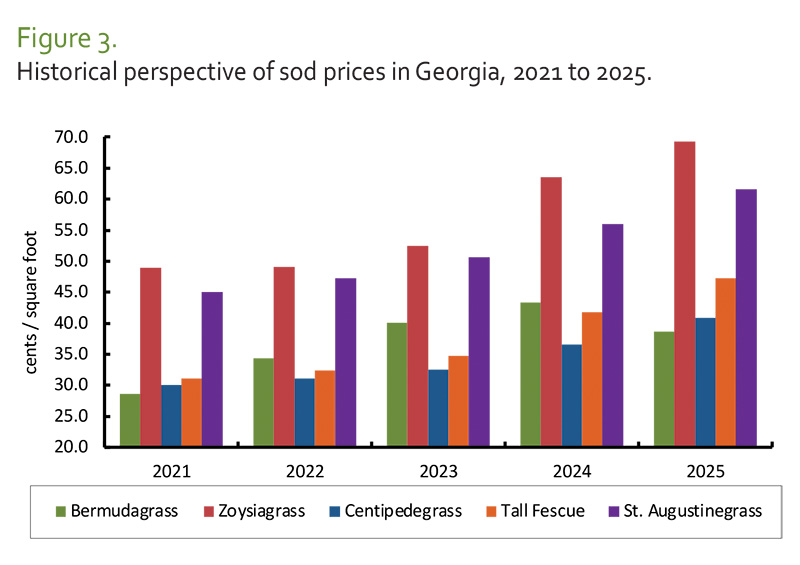

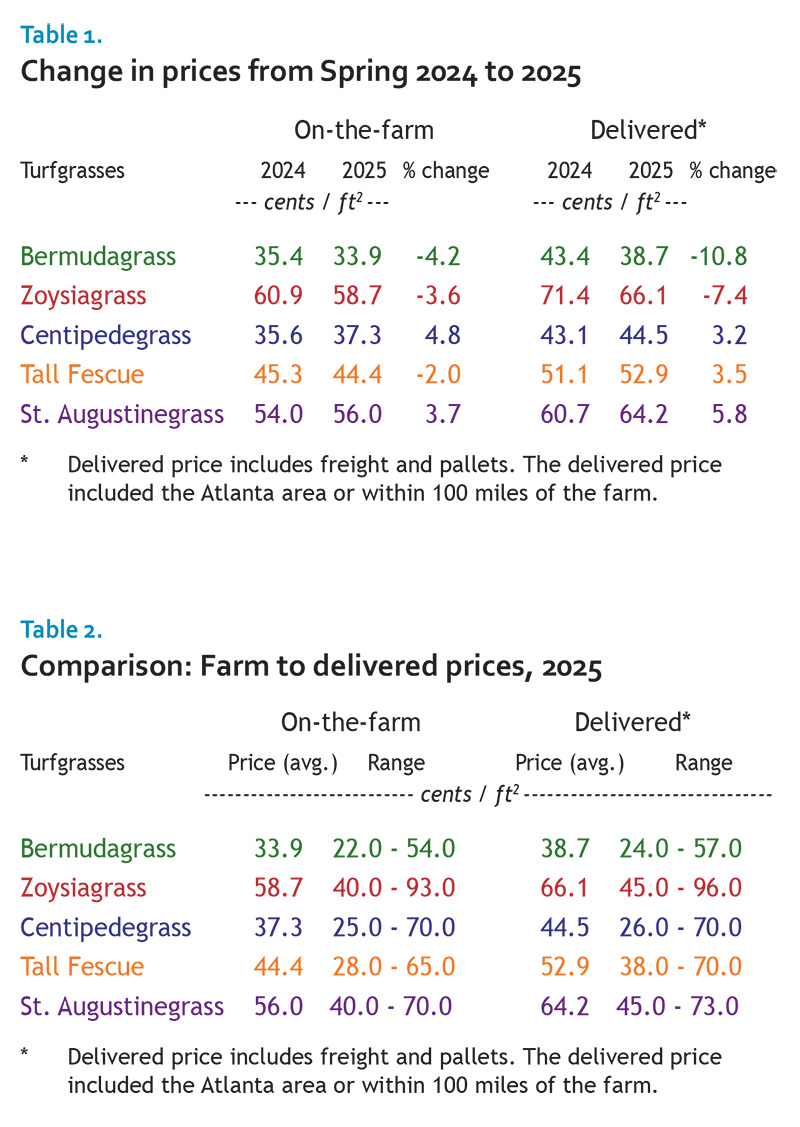

Relative to recent years, on-the-farm and delivered prices may be lower for some species in 2025. Price decreases could range from 4% to 11% compared to 2024 prices (Table 1) for bermudagrass and zoysiagrass. Centipedegrass and St. Augustinegrass are expected to increase this year. Tall fescue picked-up from the farm may be slightly (2%) less than 2024. Figure 3 provides a five-year perspective of delivered sod prices.

The average price per square foot for a truckload of bermudagrass delivered to the Atlanta area, or within 100 miles of the farm, was lower relative to 2024 (Table 1). The 2025 survey indicated prices varied from 24.0 cents to 57.0 cents, with an average price of 38.7 cents (Table 2). The average price in 2024 was 43.4 cents per square foot and ranged from 32.0 cents to 65.0 cents.

The 2025 average price for a delivered truckload of zoysiagrass was less than 2024 levels. The average price of delivered zoysiagrass in 2025 was 66.1 cents and ranged from 45.0 to 96.0 cents. In 2024 zoysiagrass prices ranged from 55.0 to 100.0 cents and averaged 71.4 cents.

Centipedegrass prices in 2025 ranged from 26.0 cents to 70.0 cents and averaged 44.5 cents, compared to 2024 when the average delivered price was 43.1 cents and ranged from 35.0 to 54.0 cents.

The 2025 average delivered price for tall fescue (52.9 cents) was 3.5% higher than 2024 (51.1 cents). This year, prices ranged from 38.0 cents to 70.0 cents.

The average price of delivered St. Augustinegrass in 2025 was 64.2 cents and ranged from 45.0 to 73.0 cents. In 2024, St. Augustinegrass prices ranged from 50.0 to 73.0 cents and averaged 60.7 cents.

Through the years there has been some discussion regarding price discrepancies between growers with fewer acres and those with many. The assumption has been that the prices charged by the larger growers are more reflective of actual sod prices than the prices charged by growers with lower inventories. If an adjustment (i.e. increase) was made to a reported price that was below one standard deviation from the mean of the larger grower’s price, delivered bermudagrass in 2025 may be closer to 41.9 cents per square foot. The “more accurate” prices for delivered zoysiagrass may, like bermudagrass, be greater than the simple averages presented in tables 1 and 2. Interestingly, price adjustments for the other species were not much different than an overall average.

Projected increases

Regarding grower price expectations, growers are consistent on sod prices holding steady throughout 2025.

Greater than 80% of warm-season species are expected to retain steady pricing this year. Fluctuation of pricing is typical throughout the growing season. Grower optimism tends to be high early in the year, but environmental and market forces can influence sod prices mid- to late in the growing season.

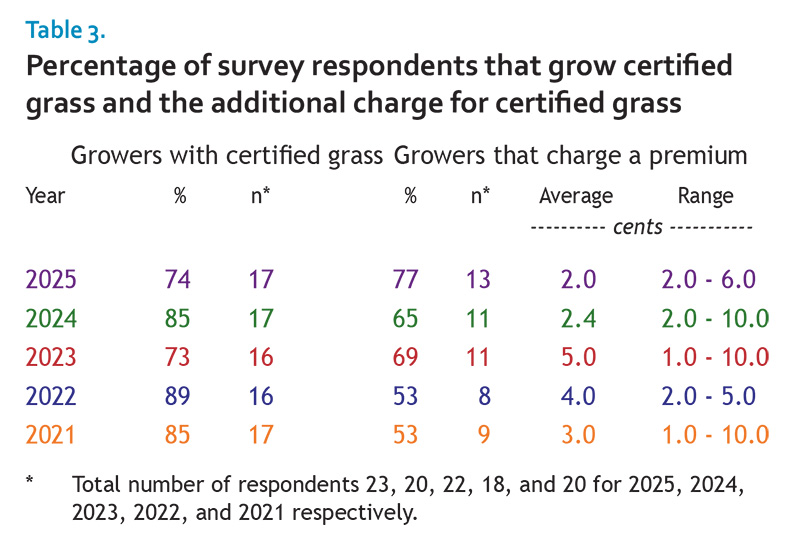

Certification

2025 had 17 producers representing 74% of the respondents with some certified grass on their farm (Table 3). Seventy-seven percent of these growers charge a premium for certified grass, up from 53% in 2021 and 2022. The remaining growers either do not place an added value on certified sod or do not participate in the certification program. In 2025, the typical extra cost ranged from 2.0 to 6.0 cents per square foot and averaged 2.0 cents. This translates to between $10.00 and $30.00 on a 500 square foot pallet.

The price point where consumers (i.e. industry practitioners and homeowners) value varietal purity is unknown. Anecdotal estimates – informal survey of a several hundred participants – of homeowners and end-consumers suggests the value of a certified grass is likely within the reported range of this survey. When made aware of the benefits of certified sod, end-users indicated they are willing to pay at least $20 / 500 square foot pallet to ensure varietal purity.

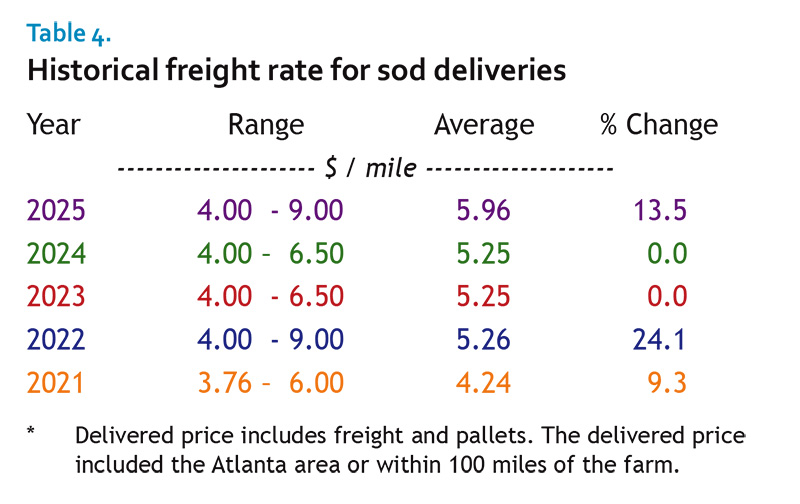

Freight, unloading fees, and fuel surcharge

In 2025 a freight rate which is variable and based on mileage, was the pricing structure for 65% of the respondents. The remaining producers charge a flat, or single fixed, rate for grass deliveries.

2025 freight rates per mile shipped to Atlanta, or within 100 miles of the farm, was up from 2024 (Table 4). This year, costs ranged from $4.00 to $9.00 and averaged $5.96.

For growers that charge flat rates, the average charge was $405. It is suspected this question needs refinement, or explanation, due to the range ($95 to $1,200) of reported per delivery charges. Flat rates exceeding $1,000 – there were multiple respondents – may be associated with truckload deliveries.

If an unloading fee is charged, it may range from $50 to $150. Most producers will make additional drops on a load. While the range ($40 to $275) was a noticeable increase from last year’s survey, the average cost for additional drops in 2025 was $115 and on-par with 2024.

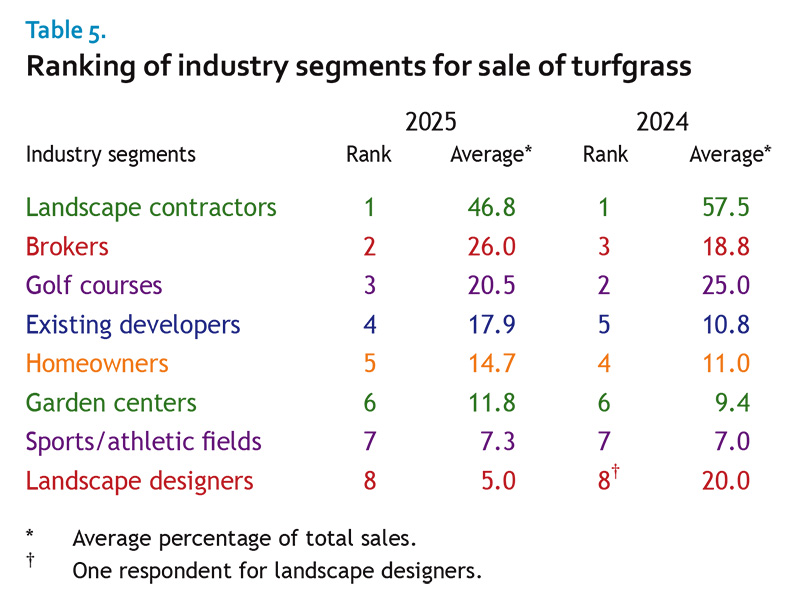

Markets

The 23 producers that participated in this survey estimated that 47% of the grass sold was to landscape contractors (Table 5). This industry segment continues to be the perennial leader and is consistent with national trends where landscape contractors are the largest marketing channel for horticulture and specialty crops (www.nass.usda.gov/Publications/Highlights/2020/census-horticulture.pdf).

Golf courses were in the third position, accounting for 21% of expected sales in 2025. It appears that on-course upgrades, renovations, and new course constructions will continue throughout the year.

Existing developers rose from the 5th rank last year to the 4th this year. This survey is likely not a good barometer of housing starts but observations throughout the state seems like development continues in many urban areas (e.g. Atlanta, Augusta, Macon, Savannah, Valdosta, etc.).

Acreage in production

Thirty percent of the surveyed producers indicated they planned to add acres into production during 2025. This year’s increase could be around 550 acres, a healthy increase from last year. Comparing the responses from this survey with the Georgia Crop Improvement Association’s “Turfgrass Buyers Guide” (www.georgiacrop.com/turf-grass) the annual increase in production continues into the 2025 growing season.

Summary

The continued upward trend in bermudagrass and zoysiagrass inventory is encouraging and likely a factor in stable pricing. While adding acres into production is expected to continue during 2025, any newly planted fields will not be reflected in this survey for another year to two.

Sod production is a cropping system unlike the rest of the turfgrass industry (i.e. maintenance) and has its own market drivers. While there is grower optimism that sod prices will remain steady, there are multiple factors that could change their perspective. Unlike many commodities, individual sod producers have the ability to alter their pricing based on these factors resulting in abrupt adjustments up or down. End users (Table 5) should compare prices while considering all the aspects of purchasing grass (i.e. certified sod, delivery charges, customer service, warranties, etc.).

Clint Waltz is Professor and Turfgrass Extension Specialist at the University of Georgia campus in Griffin, GA.